Oil Fundamentals

Whilst oil is seemingly determined to fall back below $60 a barrel everytime it rises above that level, the fundamentals are still unaffected. So, after hedge funds and speculators took a profit with a large futures sell off during September, has anything really changed? Well - yes and no.

Yes, because we have seen some unseasonaly warm weather, a damp squib of a hurricane season and therefore, increasing amounts of spare capacity. In theory we could see more and more production capacity increases, and thus more and more oil, leading to the price falling further. There is also a reasonable chance of a US recession in 2007, what affect that would have on demand is unknown, but would almost certainly ease demand.

But what about geopolitical worries? Whilst the Lebanon-Israel war has ended - for now, the Iran crisis has hardly eased off, and North Korea has detonated, however small, a nuclear weapon. The geopolitical optimism sweeping the markets seems a tad strange.

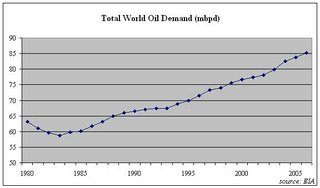

Nonetheless, I am convinced that these factors, relating to the short-term trends and speculation of the oil price, are simply an aside to the most important factor driving the oil megatrend, China. Exhibit one is this graph, showing World Oil Demand:

The 2001 recession doesn't seem to have led to a large reduction in total oil demand. And if we are seeing a reduction in US demand, China doesn't seem to be reducing its oil demand. The latest figures for Chinese oil imports show a 24% increase in oil imports in September alone.

I'm not a speculator, the only shares I have are buy and hold jobs which I am probably overattached to, to ever be succesful as a trader. But, long termism has its benefits. The fact is the oil price is in a long-term trend, and this outlook points towards continuing inflationary pressure, and, eventually, $80+ oil.